2008-02-07 23:00:04 hatch

shadow

Good evening.

2008-02-07

23:10:28 hatch shadow

Hard to borrow stocks: ACAS ,DRYS ,FMCN, HOLX, SHLD and SPWR.

2008-02-07

23:11:26 hatch shadow

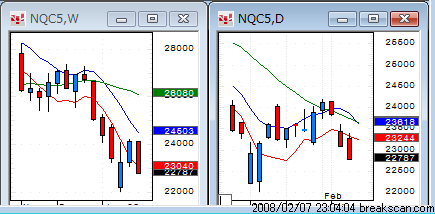

The market recorded three straight down days.

2008-02-07

23:11:35 hatch shadow

The futures are weak now.

2008-02-07

23:12:00 hatch shadow

Watch out for a reversal. The market already made three

consecutive down days.

2008-02-07

23:12:22 hatch shadow

Stocks with downside gaps: GOOG, FSLR, BIDU , AAPL, FWLT,

QCOM, MELI, FISV, AMZN, PCLN, MSFT, LRCX, ADBE, ERTS , ADSK

and KLAC.

2008-02-07

23:17:22 hatch shadow

Stocks with upside gaps: AKAM .

2008-02-07

23:30:14 hatch shadow

The market has opened.

2008-02-07

23:30:55 hatch shadow

Short QCOM, KLAC and APOL.

No trade

Up $100 for 500 shares.

No trade.

2008-02-07

23:31:05 hatch shadow

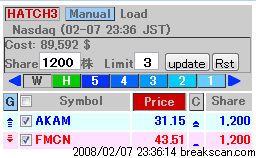

Long AKAM.

Up $510 for 1000 shares.

2008-02-07

23:31:49 hatch shadow

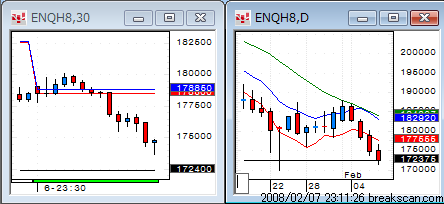

BIDU, a 30-min. gap

pattern.

Up $203 for 100 shares

Up 154 for 50 shares.

2008-02-07

23:35:57 hatch shadow

ISRG.

Up $246 for 100 shares.

2008-02-07

23:37:05 hatch shadow

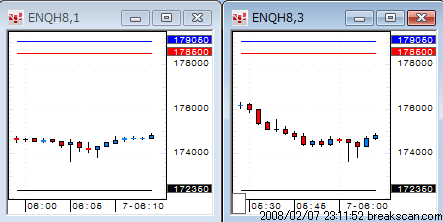

hatch 3.

2008-02-07

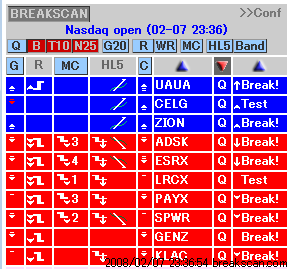

23:37:40 hatch shadow

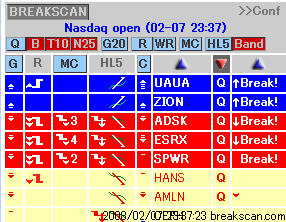

Breakscan.

Long again after bottoming out.